Income Withholding For Support free printable template

Show details

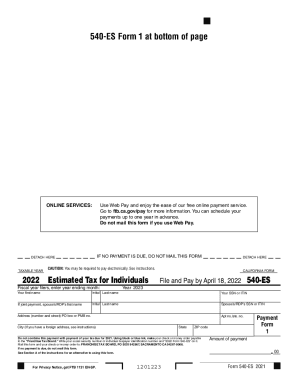

You must however separately identify each Payments To SDU You must send child support payments payable by income withholding to the appropriate SDU or to a Tribal CSE agency. Acf.hhs. gov/programs/cse/newhire/employer/contacts/contactmap.htm Priority Withholding for support has priority over any other legal process under State law against the same income USC 42 666 b 7. INCOME WITHHOLDING FOR SUPPORT ORIGINAL INCOME WITHHOLDING ORDER/NOTICE FOR SUPPORT IWO AMENDED IWO ONE-TIME ORDER/NOTICE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign order withholding form

Edit your illinois income withholding for support form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income withholding for support form for texas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit income withholding for support form online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit income withholding for child support form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

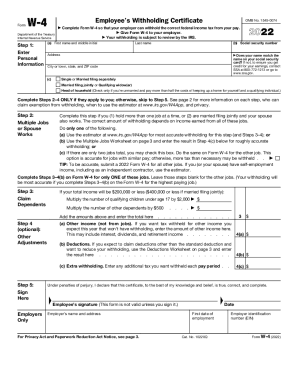

How to fill out income withholding form

How to fill out Income Withholding for Support

01

Obtain the Income Withholding for Support (IWO) form from your local child support agency or online.

02

Fill in the header section with the case information including the name of the payee and payer.

03

Enter the court order details, including the case number and the date of the order.

04

Complete the section for the obligor's personal information, including name, address, and Social Security number.

05

Fill out the employer's information in the appropriate section.

06

Specify the amount to be withheld for child support in the designated field.

07

Review the completed form for accuracy and correctness.

08

Submit the form to the appropriate employer of the obligor, and keep a copy for your records.

Who needs Income Withholding for Support?

01

Parents or guardians who are entitled to receive child support payments.

02

Individuals involved in a court case regarding child support obligations.

03

Employers who are required to withhold income for child support from an employee's wages.

Fill

pdffiller

: Try Risk Free

People Also Ask about federally mandated income withholding for support in texas

What is an earnings withholding order?

Earnings Withholding Order for Taxes (EWOTs) These are wage garnishments, where employers are required to withhold a portion of the employee's income and pay that money to the issuing agency in order to repay an outstanding debt.

What is a FL 195 form?

Tells an employer that the court made an order for you or the other person in the case to pay child support, medical support, spousal or domestic partner support (and any past-due support).

How much can child support take from your check in Kansas?

Income Withholding Limit: The Kansas limit for income withholding orders is 50% of disposable income. If there is more than one IWO for an employee, the 50% limit still applies. E.

What is an income withholding order for child support in Kansas?

What is an Income Withholding Order? Pursuant to K. S. A. 23-3102(e), an Income Withholding Order is a continuing order requiring an employer to withhold a set dollar amount from all pay periods of an employee who is responsible for child support (and may include spousal support or alimony).

What is the income withholding for support in Ohio?

An employer may not withhold more than 50 percent of an employee's disposable income if the employee supports another dependent, or 60 percent if the employee does not support someone else.

What is income withholding child support Indiana?

The income withholding law permits child support enforcement offices operating under the Child Support Program to require any employer to withhold current and delinquent child support obligations from an employee's earnings.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send how to fill out income withholding for support form for eSignature?

Once you are ready to share your iwo form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an electronic signature for signing my income withholding order arizona in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your find the form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out order to withhold income for child support texas using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign Income Withholding For Support and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is Income Withholding for Support?

Income Withholding for Support is a legal mechanism used to collect child or spousal support payments directly from an individual's income, such as wages or retirement benefits, ensuring timely and consistent payment.

Who is required to file Income Withholding for Support?

Typically, the custodial parent or the agency handling child support is required to file an Income Withholding for Support with the employer or relevant income provider of the non-custodial parent.

How to fill out Income Withholding for Support?

To fill out Income Withholding for Support, the filer must provide complete information regarding the non-custodial parent, custodial parent, court case number, amount to be withheld, and employer details. Follow the specific instructions provided on the form or by the local child support agency.

What is the purpose of Income Withholding for Support?

The purpose of Income Withholding for Support is to ensure that support payments are made automatically and consistently, thus reducing the risk of non-payment and providing financial stability for the child or spouse receiving support.

What information must be reported on Income Withholding for Support?

Information that must be reported includes the names and addresses of the custodial and non-custodial parents, the court case number, the withholding amount, the frequency of payment, and the employer's name and address.

Fill out your Income Withholding For Support online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Withholding For Support is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.